What Is a Statement of Financial Position?

In all cases, net Program Fees must be paid in full (in US Dollars) to complete registration. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program.

To get a jumpstart on building your financial literacy, download our free Financial Terms Cheat Sheet. If you’re new to the world of financial statements, this guide can help you read and understand the information contained in them. Obviously, internal management also uses the financial position statement to track and improve operations over time. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

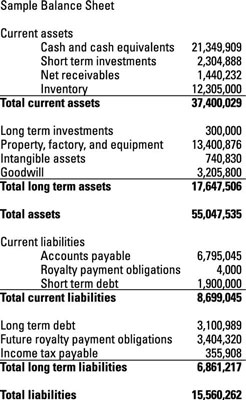

The standard format for the balance sheet is assets, followed by liabilities, then shareholder equity. The statement of financial position, also known as the balance sheet, is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. The balance evaluate a nonprofit sheet can be used to give insights into a company’s financial strength and health.

Part 2: Your Current Nest Egg

While the annual report offers something of a narrative element, including management’s vision for the company, the 10-K report reinforces and expands upon that narrative with more detail. An ability to understand the financial health of a company is one of the most vital skills for aspiring investors, entrepreneurs, and managers to develop. Armed with this knowledge, investors can better identify promising opportunities while avoiding undue risk, and professionals of all levels can make more strategic business decisions. The non-current assets section includes resources with useful lives of more than 12 months. In other words, these assets last longer than one year and can be used to benefit the company beyond the current period.

Retain Earning or Accumulated Losses/ Profit :

The balance sheet is a financial statement that provides an overview of a company’s assets, liabilities, and equity. It is used to assess a company’s financial situation at a given point in time. On the balance sheet, assets and liabilities are broken into current and non-current items. Current assets or current liabilities are those with an expected life of fewer than 12 months.

- Your bank uses this information to assess the strength of your financial position; it looks at the quality of the assets, such as your car and your house, and places a conservative valuation upon them.

- When interpreting the data, it is important to consider the limitations of the information and use other resources to supplement the analysis.

- From the balance sheet above, we can see that as of September 2021, Apple, Inc.’s total assets amount to $351,002,000.

- At the time of deposit, the entity does not receive the computer from its supplier yet.

What Are Financial Statements?

Companies use CFF to assess their operations’ ability to finance and make decisions about issuing new equity and debt financing. This indicates the amount of money the company has generated or used from its financing activities. In this example, we can see that ABC Limited Liability Company’s total assets increased from $300,000 in 2021 to $370,000 in 2022.

Current liabilities are the company’s liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables (AP), which are the bills and obligations that a company owes over the next 12 months (e.g., payment for purchases made on credit to vendors). If we subtract total liabilities from assets, we are left with shareholder equity.

Third, management can manipulate financial statements to give a false impression of the business bookkeeping company’s financial health. For example, a company might recognize revenue early or delay expenses to make the financials look better than they actually are. First, financial statements only provide a snapshot of a company’s financial position at a specific point in time.

He recognized that “a lot of people don’t understand keeping score in allowance for doubtful accounts and bad debt expenses business. They get mixed up about profits, assets, cash flow, and return on investment.” The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified duration of time, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of it. An income statement, also known as a profit and loss (P&L) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period.