7 Basic Accounting Workflow Templates + Free Diagrams & Flowchart

Though every client is unique, a lot of the work that goes into a tax return is repetitive and can be tracked through a standard workflow. Each tax return workflow should start with a single person being assigned to monitor the progress of the return. The specific answer to this question can vary somewhat depending on the extent of bookkeeping services your company needs, and how often you require the services of a small business bookkeeper. For full-time bookkeepers, the average annual salary sits around $77,000, according to Glassdoor. The specific amount of an emergency fund may depend on the size, scope, and operational costs of a given business.

How to Start Bookkeeping in a Small Business

In many instances, an accountant prepares the initial chart, and the bookkeeper references it while recording transactions. Below are some of the most common statements a bookkeeper how is a voucher used in accounts payable uses to monitor activities. This is particularly true once the business accounts for its operational costs and recurring expenses.

Establishes relationships between tasks to ensure that involved parties complete them in the correct sequence. Task dependencies help maintain the flow of the bookkeeping process and prevent bottlenecks caused by incomplete or out-of-order tasks. Managers love that they can see real-time updates and progress reports for multiple projects and distribute work evenly to their teams. Team members love that they know what the expectations are for projects and can visually prioritize their most important tasks. It’s common to find that there is additional information needed that wasn’t apparent at the start of the projects. You may spot payments on a loan and need to go back and ask for loan statements, or the client purchased a new fixed asset that requires additional information to be properly categorized.

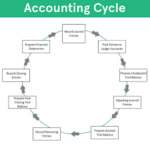

Benefits of Accounting Flowcharts

When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor. Maintaining bookkeeping tasks is essential for the stability and success of small businesses. With so many moving pieces (including assets and liabilities, and income and expenses), small business owners must stay on top of it all. Your workflow platform doesn’t need how many erp systems are there in the world to have it all if it integrates well with third-party apps. In fact, integrations might be preferable if you have accounting software you love already, for example, and don’t want to switch. Now it’s time to present your fantastic new workflows in a way that will drive engagement.

- There are several steps to consider when setting up an initial workflow.

- The most common outcomes of the decision stage are Yes and No, although it can be more.

- For anyone who has taken an accounting class, you know that the biggest difference between the textbook cases and the actual accounting experience is that in class, you’re given all the necessary information upfront.

- You can use flowcharts to describe to your new hires the processes they would need to follow when doing any work they are assigned.

- As accountants and bookkeepers, we know that there’s no need to reinvent the wheel.

There are countless options out there for bookkeeping software that blends a good price with solid features and functionality. But if you’re looking for one that’s simple to use and understand, but doesn’t compromise on the features you need, FreshBooks’ cloud-based bookkeeping solution and accounting software might be the right choice for you. Do you have more questions about the bookkeeping process for small businesses? Wondering how best to collect and track financial information, deal with expense management, and ensure healthy cash flow for your business? Here are some of the most frequently asked questions on bookkeeping for small businesses.

Why You Need a Bookkeeping Workflow

Professional bookkeepers prepare and track financial documents, including invoices and bills, and create financial statements to ensure the business is ready for tax season and other financial reporting requirements. It ensures you stay organized, complete tasks on time, have accurate financial reports, and can effectively manage your clients’ finances. You can also use this checklist to train new staff to promote consistency and quality in your bookkeeping services. As businesses grow, it becomes easier to let small activities slip. Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity.

Everything You Need to Supercharge Your Firm’s Accounting Workflow

Bookkeeping is different from accounting in that it is the critical first step in tracking all business activities. While bookkeeping provides oversight into each individual transaction (in order to catch discrepancies and correct mistakes), accounting provides a thorough analysis of these numbers. It might not be possible to automate the entire process from start to finish, but you may be profit and loss questions able to gain some quick wins by automating small steps within a process. Understand the workflows you need for your accounting or bookkeeping practice, and how to create them.

But if you have an office and clients mail documents to you, someone has to be in the office to open the mail and scan it or route it to the right person. Want to enable better, faster decision-making for your small business clients? The “to do” feature gives me a single list that shows me what clients have been completed (yay!) and who is left to complete (boo!). 17Hats also has a great feature called “lifecycle” which is a high-level overview of a project that shows what has been completed for that client. So just get started – it doesn’t have to be perfect, it just has to be started. Automates tasks like following up with clients and reminding them to upload the information you need with the client task feature, saving you time and effort.